-

धमाका! 18 मार्च को Honor ला रहा नए फोन, वॉच और बैंड!

टेक दिग्गज Honor 18 मार्च को एक इवेंट आयोजित करने वाला है, जहां कंपनी अपने नए स्मार्टफोन्स के साथ ही एक नई स्मार्टवॉच और एक…

-

Indian FTR नए रंगों में हुआ लॉन्च! स्ट्रीट पर मचाएगा धूम!

बाइक प्रेमियों के लिए खुशखबरी! अमेरिकी दिग्गज इंडियन मोटरसाइकिल ने अपनी लोकप्रिय फ्लैट ट्रैकर बाइक FTR के नए रंगों से पर्दा उठा दिया है। अभी…

-

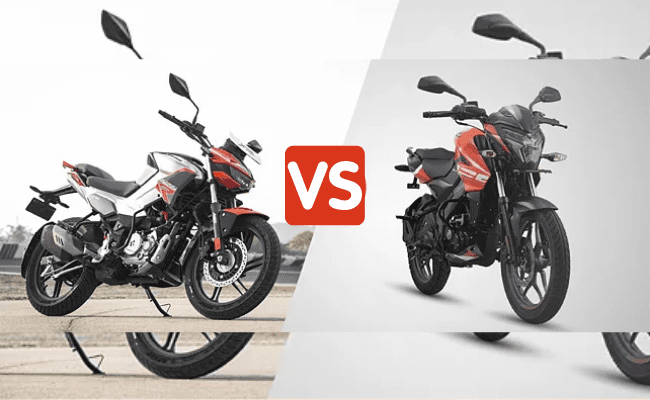

125cc धमाल! Xtreme 125R vs Pulsar NS125: जानें पूरी तुलना!

125cc सेगमेंट की बाइक्स युवाओं के बीच काफी पसंद की जाती हैं। इन बाइक्स में अच्छी माइलेज, दमदार इंजन और किफायती कीमत का शानदार कॉम्बिनेशन…

-

लेनोवो का नया धाकड़ लैपटॉप! Yoga Slim 7i में OLED और Core Ultra 7 का धमाल!

लेनोवो का धमाकेदार लॉन्च! Yoga Slim 7i में मिला OLED डिस्प्ले और दमदार Core Ultra 7 प्रोसेसर! लेनोवो ने भारत में अपना नया लैपटॉप, Yoga…

-

8.8 इंच 2.5K डिस्प्ले, 144Hz रिफ्रेश रेट! गेमर्स के लिए Lenovo Legion Tab!

Lenovo Legion Tab ग्लोबल बाजार में हुआ लॉन्च! 8.8 इंच 2.5K 144Hz डिस्प्ले! Snapdragon 8+ Gen 1 प्रोसेसर, 12GB रैम, 256GB स्टोरेज! 45W फास्ट चार्जिंग…

-

10,999 रुपये से शुरू! BenQ के नए धांसू मॉनिटर्स! 100Hz रिफ्रेश रेट

BenQ GW सीरीज मॉनिटर्स भारत में लॉन्च! 24-27 इंच डिस्प्ले, 100Hz रिफ्रेश रेट, आंखों की सुरक्षा! काम के लिए भी, मनोरंजन के लिए भी! 10,999…

-

बजट स्मार्टफोन में धमाल! Moto G04 हुआ लॉन्च, खासियतें चौंका देंगी!

Moto G04 के 4GB रैम + 64GB स्टोरेज वाले वेरिएंट की कीमत ₹6,999 है, जबकि 8GB रैम + 128GB स्टोरेज वाले वेरिएंट की कीमत ₹7,999…

-

Xiaomi Mix Fold 4 लॉन्च में हो सकती है देरी, Xiaomi 14 Ultra के साथ नहीं होगा लॉन्च!

टेक जगत में अक्सर ऐसी खबरें आती रहती हैं जो फैंस को उत्साहित करती हैं, लेकिन कभी-कभी ऐसी खबरें भी आती हैं जो उनके उत्साह…

-

4 डिस्प्ले, लग्जरी का तड़का! Jeep Wagoneer S का इंटीरियर धमाकेदार! जानें सबकुछ!

अमेरिकी कार निर्माता, Jeep, इलेक्ट्रिक वाहनों की दुनिया में धमाकेदार एंट्री करने की तैयारी में है। कंपनी ने अपने आगामी इलेक्ट्रिक SUV, Wagoneer S के…

-

Hero Xtreme 125R का पहला लुक लीक, फीचर्स जानकर चौंकेंगे!

Hero MotoCorp अपनी धांसू Xtreme सीरीज़ में एक नया शेर जोड़ने की तैयारी में है – Hero Xtreme 125R। ये 125cc कम्यूटर बाइक जल्द ही…

-

स्टाइलिश कलाई के लिए! छोटी Google Pixel Watch 3 आ रही है!

Google अपना लोकप्रिय स्मार्टवॉच, Pixel Watch एक नए अवतार में लाने की तैयारी में है। लेकिन इस बार एक बड़े सरप्राइज के साथ – दो…

-

️ धमाका! Vivo Y100 5G का नया अवतार! फीचर्स बवाल मचाएंगे! लॉन्च जल्द!

वीवो के फैंस खुश हो जाइए! कंपनी अपने लोकप्रिय 5G स्मार्टफोन, Vivo Y100 5G को एक नए अंदाज में वापस लाने की तैयारी में है।…